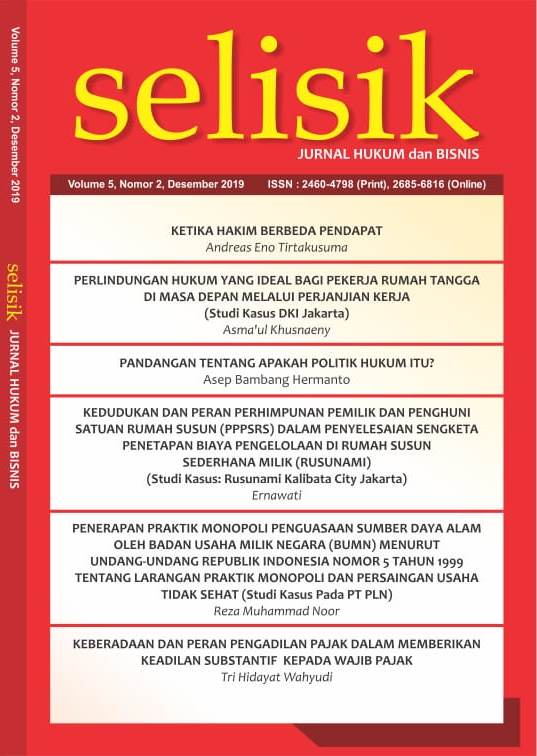

KEBERADAAN DAN PERAN PENGADILAN PAJAK DALAM MEMBERIKAN KEADILAN SUBSTANTIF KEPADA WAJIB PAJAK

Abstract views: 600 | pdf (Bahasa Indonesia) downloads: 1196

Abstract

The Indonesian Tax Court was established with the enactment of Law Number 14 of 2002which aims to establish a Taxation Court that is integrated with the judicialsystem under the Supreme Court, and and is able to create justice and legal certainty in decision of resolving Tax Disputes. Research carried out using normative legal research methods is intended to test whether the Tax Court has been sette as an independent institution under the Supreme Court, and the procedural law stipulated in Law No. 14 of 2002. Also conducted research of the results of the tax court decision was reviewed to the Supreme Court. The research results indicate that both the general principles of the court and the specific principles as a state administrative court can be fulfilled by the procedure law of Tax Court, and the examination of the results of the Tax Court's decision that was reviewed to the Supreme Court, indicate that 84.65% of the Tax Court's decision decision was retained by the Supreme Court in the judicial review decision.

This work is licensed under a Creative Commons Attribution 4.0 International License.

.gif)

1_(1).jpg)