Study of Awareness Patterns of Credit Card Users towards Ads with K-Means Clustering Algorithm

DOI:

https://doi.org/10.35814/asiimetrik.v7i2.8295Keywords:

advertising, credit card users, clustering, K-MeansAbstract

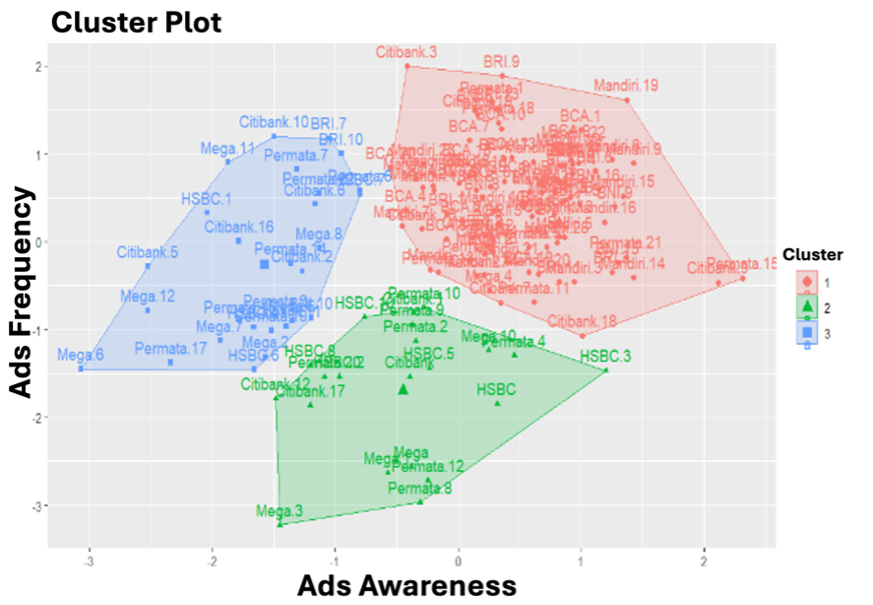

In the era of digital transformation, credit cards have become an essential component of modern financial life, where users’ understanding of card features significantly influences their financial decisions. Despite the wide use of advertising in the financial sector, limited studies have explored how credit card users in emerging markets respond to such campaigns. Addressing this gap, this study analyzes advertisement awareness patterns among credit card users in Indonesia using the K-Means Clustering algorithm on a dataset collected from August 2023 to March 2024. The study aims to examine levels of advertisement awareness, segment users based on their responses, and assess the implications of these segments for marketing strategies. The methodology follows the Knowledge Discovery in Database (KDD) process: data selection, preprocessing, transformation, clustering with K-Means, and evaluation using the Silhouette Score. Results reveal three distinct user clusters: (1) highly aware users in large cities with high exposure; (2) moderately aware users from mid-tier cities; and (3) low-awareness users despite high exposure, often from older age groups and lower SES backgrounds. The clustering yielded Silhouette Scores above 0.60, validating segmentation quality. The novelty lies in applying machine learning to segment awareness levels using a multi-city real-world dataset. The findings offer practical value for credit card providers to enhance targeted campaigns, improve user engagement, and allocate marketing resources more effectively across demographic segments.

Downloads

References

Behera, C.K. and Dadra, R. (2024) ‘Understanding Young Consumers’ Attitude Formation For New-Age Fintech Credit Products: An SOR Framework Perspective’, Journal of Financial Services Marketing, 29(3), pp. 964–978. Available at: https://doi.org/10.1057/s41264-023-00247-3.

Biradar, J. (2024) ‘Factors Affecting Debit Card and Credit Card Use in India’, Bimaquest, 24(1), pp. 21–41.

Fulford, S.L. and Schuh, S.D. (2024) ‘Credit cards, credit utilization, and consumption’, Journal of Monetary Economics, 148, p. 103619. Available at: https://doi.org/10.1016/j.jmoneco.2024.103619.

Grodzicki, D. (2023) ‘The Evolution of Competition in the Credit Card Market’. Available at: https://doi.org/10.2139/ssrn.4493211.

Hesananda, R. (2021) Algoritma Klasifikasi Bibit Terbaik untuk Tanaman Keladi Tikus. Jakarta: Penerbit NEM. [Print].

Hesananda, R. and Agustian, E.Y. (2024) Generasi Z dan Data Mining: Panduan Klasifikasi Pinjaman Bank sebagai Data Analis Keuangan. Jakarta: Penerbit NEM. [Print].

Laras, A. (2024) ‘Gesekan Transaksi Kartu Kredit Kembali Tumbuh pada Awal 2024’, Bisnis.com. Available at: https://finansial.bisnis.com/read/20240506/90/1763002/gesekan-transaksi-kartu-kredit-kembali-tumbuh-pada-awal-2024 (Accessed: 7 April 2024).

Medina, P.C. (2021) ‘Side Effects of Nudging: Evidence from a Randomized Intervention in the Credit Card Market’, The Review of Financial Studies, 34(5), pp. 2580–2607. Available at: https://doi.org/10.1093/rfs/hhaa108.

Ming, Y., Chen, J. (Elaine) and Li, C. (2021) ‘The Impacts Of Acquisition Modes On Achieving Customer Behavioral Loyalty: An Empirical Analysis Of The Credit Card Industry From China’, International Journal of Bank Marketing, 39(1), pp. 147–166. Available at: https://doi.org/10.1108/IJBM-07-2020-0382.

Mozumder, M.A.S. et al. (2024) ‘Optimizing Customer Segmentation in the Banking Sector: A Comparative Analysis of Machine Learning Algorithms’, Journal of Computer Science and Technology Studies, 6(4), pp. 01–07. Available at: https://doi.org/10.32996/jcsts.2024.6.4.1.

Omol, E. et al. (2024) ‘Application Of K-Means Clustering For Customer Segmentation In Grocery Stores In Kenya’, International Journal of Science, Technology & Management, 5(1), pp. 192–200. Available at: https://doi.org/10.46729/ijstm.v5i1.1024.

Qiu, Y. and Wang, J. (2024) ‘A Machine Learning Approach to Credit Card Customer Segmentation for Economic Stability’, in Proceedings of the 4th International Conference on Economic Management and Big Data Applications (ICEMBDA) 2023. The 4th International Conference on Economic Management and Big Data Applications (ICEMBDA) 2023, Tianjin, China: EAI, pp. 1–9. Available at: https://eudl.eu/doi/10.4108/eai.27-10-2023.2342007.

Rishi, B., Mallick, D.K. and Shiva, A. (2024) ‘Examining The Dynamics Leading Towards Credit Card Usage Attitude: An Empirical Investigation Using Importance Performance Map Analysis’, Journal of Financial Services Marketing, 29(1), pp. 79–96. Available at: https://doi.org/10.1057/s41264-022-00181-w.

Rizaty, M.A. (2023) Data Jumlah Kartu Kredit di Indonesia (Agustus 2022-Agustus 2023), Data Indonesia: Data Indonesia for Better Decision. Valid, Accurate, Relevant. Available at: https://dataindonesia.id/keuangan/detail/data-jumlah-kartu-kredit-di-indonesia-agustus-2022agustus-2023 (Accessed: 7 August 2024).

Sekaran, K.C.C. (2024) ‘Customer Segmentation And Behaviour Analysis Using RFM And K-Means Clustering’, Nanotechnology Perceptions, 20(S12), pp. 874–886. Available at: https://doi.org/10.62441/nano-ntp.vi.2405.

Soetan, T.O. and Mogaji, E. (2024) Financial Services in Nigeria: The Path Towards Financial Inclusion, Economic Development and Sustainable Growth. Newcastle, United Kingdom: Springer Nature (Sustainable Development Goals Series). Available at: https://keele-repository.worktribe.com/output/1019543/financial-services-in-nigeria-the-path-towards-financial-inclusion-economic-development-and-sustainable-growth (Accessed: 7 August 2025).

Tressa, N. et al. (2024) ‘Customer-Based Market Segmentation Using Clustering in Data mining’, in 2024 2nd International Conference on Intelligent Data Communication Technologies and Internet of Things (IDCIoT). 2024 2nd International Conference on Intelligent Data Communication Technologies and Internet of Things (IDCIoT), Bengaluru, India: IEEE, pp. 687–691. Available at: https://doi.org/10.1109/IDCIoT59759.2024.10467258.

Downloads

Published

Issue

Section

License

Copyright (c) 2025 Jurnal Asiimetrik: Jurnal Ilmiah Rekayasa & Inovasi

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.